#barcelonawinebar

Sometimes unexpected life situations arise causing any one of us to face difficult situations. When these situations occur, we want to make sure we have a safety net in place for our employees and their loved ones.

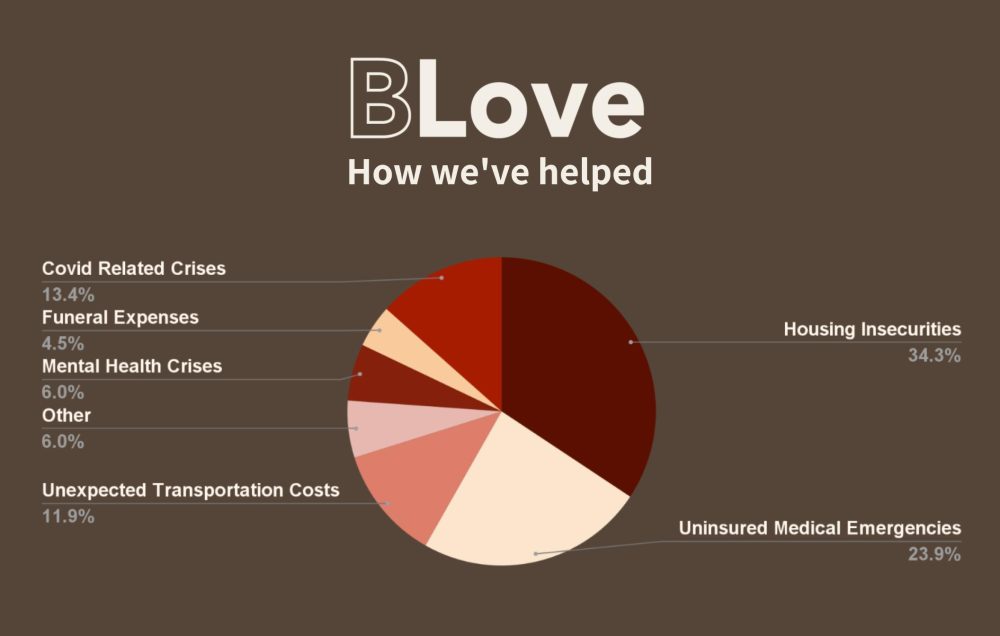

Relief can be needed for many reasons:

To assist with life-saving and supporting medications and medical attention. To assist with the care of a sick family member or dependent. To assist with housing, food, and utilities in situations where no other resources are possible. And more.

Any employee of Barcelona Wine Bar may apply for assistance through the BLOVE Employee Relief Fund Application.

Question: What type of organization is BLove?

Answer: BLove is a Section 501(c)(3) is the portion of the US Internal Revenue Code that allows for federal tax exemption of nonprofit organizations, specifically those that are considered public charities, private foundations or private operating foundations. Our Federal Tax ID is 20-8931223

Question: Are my fund contributions tax deductible?

Answer: Yes, you can claim a deduction when filing your annual taxes.

Question: How does a Barcelona employee in need become a recipient of BLove funds?

Answer: Applications received will be reviewed fairly and timely by the BLOVE Relief Fund Committee and requests for funds will be kept strictly confidential. Requests for assistance must include appropriate supporting documentation.

Want to learn more about the BLove Employee Assistance Fund?

Email: BLove@barcelonawinebar.com